- Dapatkan link

- X

- Aplikasi Lainnya

- Dapatkan link

- X

- Aplikasi Lainnya

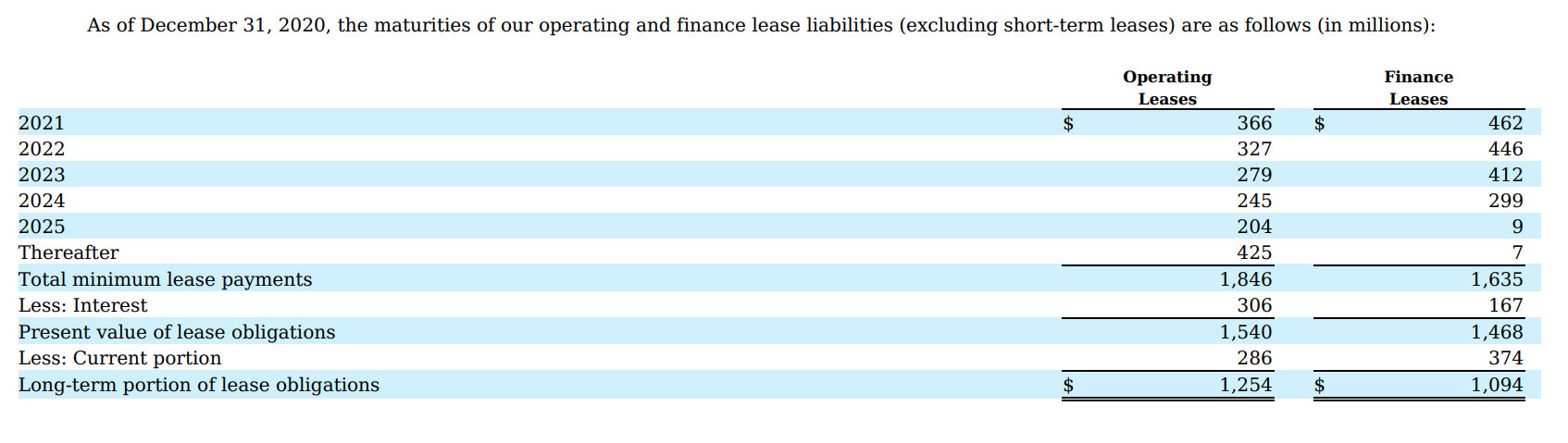

Tesla long term debt for 2019 was 11634B a 2371 increase from 2018. According to the Teslas most recent financial statement as reported on July 28 2020 total debt is at 1410 billion with 1042 billion in long-term debt and 368 billion in.

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

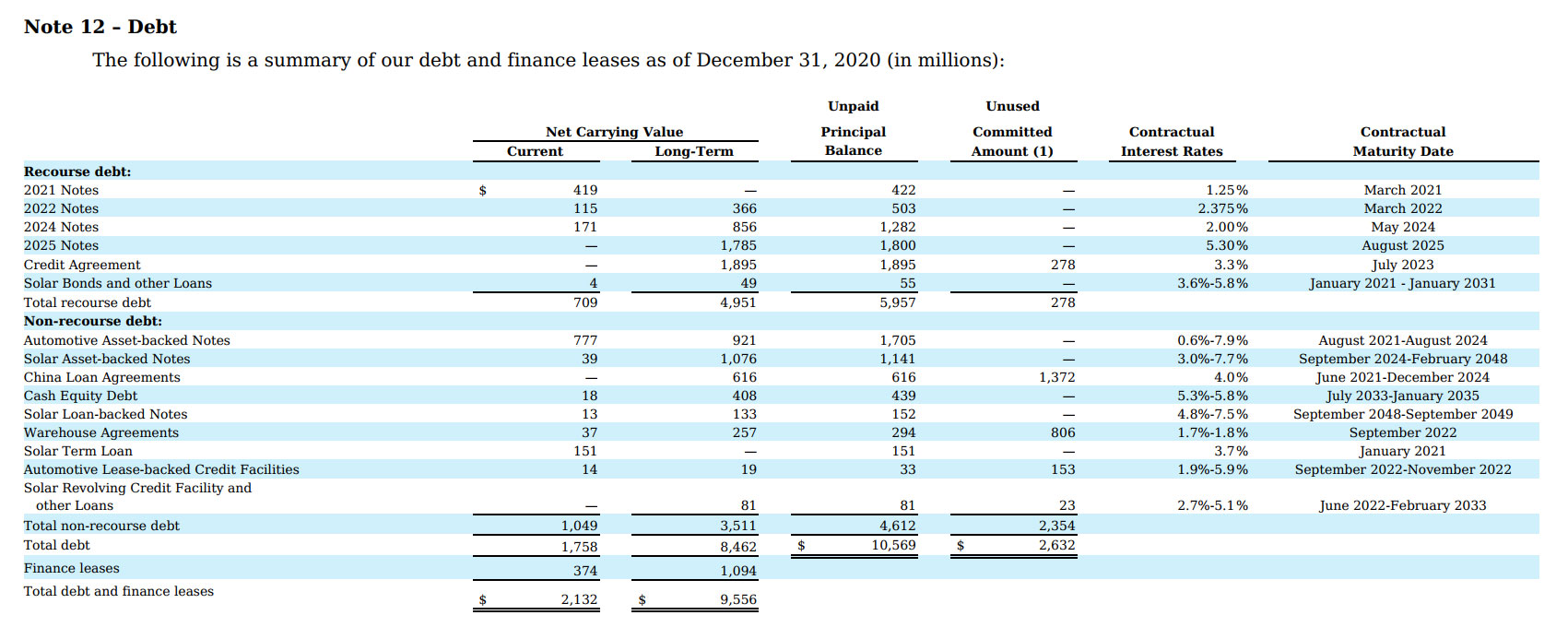

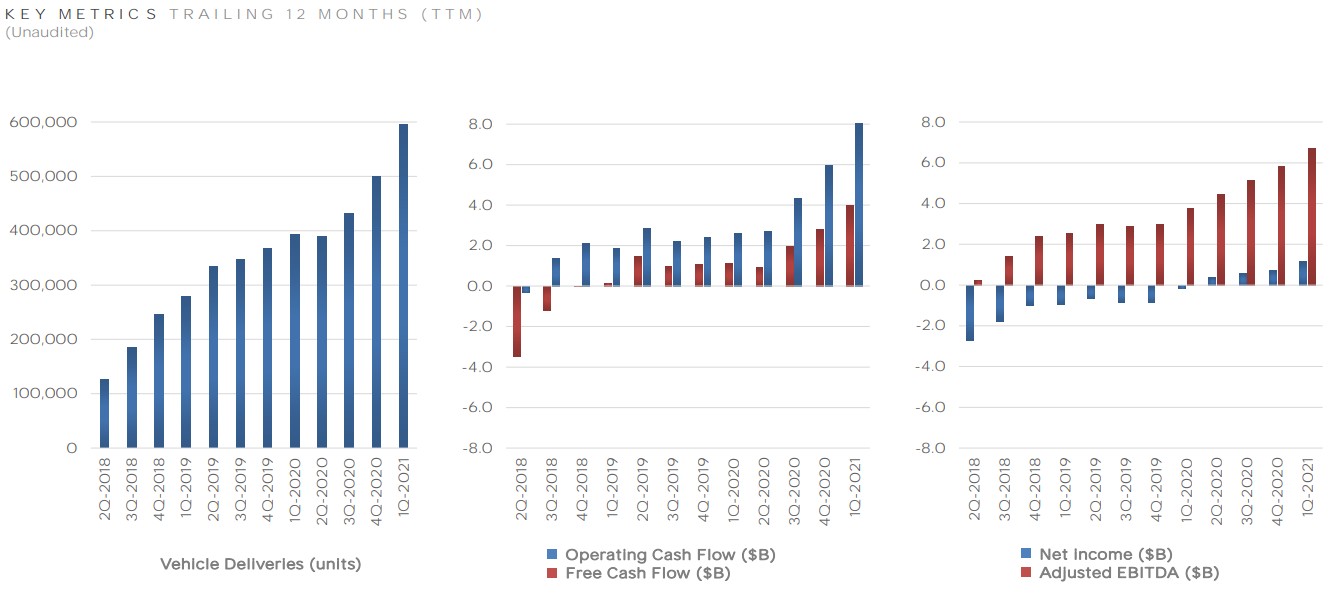

Quarterly Annual Figures for fiscal year ending 2020-12-31.

Tesla debt 2020. Long-Term Debt to Equity 4899. Tesla Incs debt to capital ratio including operating lease liability improved from 2018 to 2019 and from 2019 to 2020. A solvency ratio calculated as total debt divided by total shareholders equity.

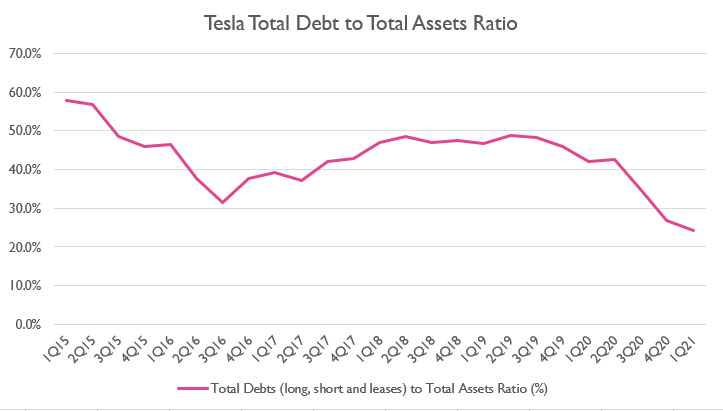

According to the Teslas most recent financial statement as reported on July 28 2020 total debt is at 1410 billion with 1042 billion in long-term debt and 368 billion in current debt. Tesla LT-Debt-to-Total-Asset Historical Data. Total Debt to Total Assets 2559.

Long-Term Debt to Assets 021. According to the Teslas most recent financial statement as reported on July 28 2020 total debt is at 1410 billion with 1042 billion in long-term debt and 368 billion in current debt. Compare TSLA With Other Stocks.

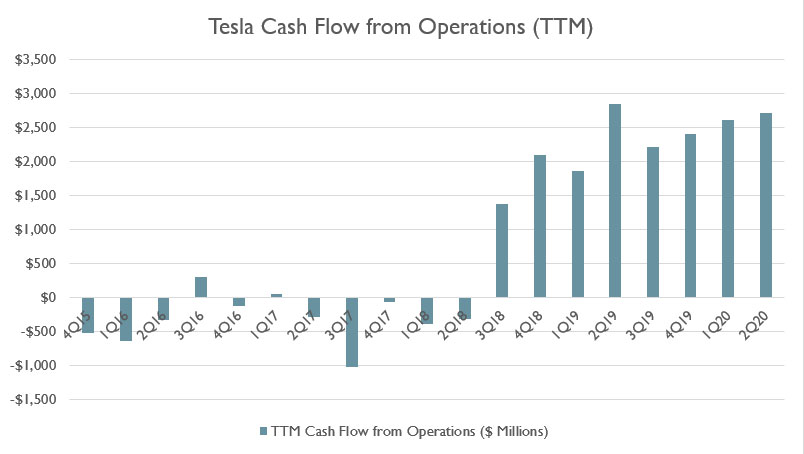

Date Long Term Debt Shareholders Equity Debt. On a quarterly basis Teslas interest expense reached as much as 246 million as of 4Q 2020. It may suggest that Tesla is progressively becoming less dependent on debt to grow their business.

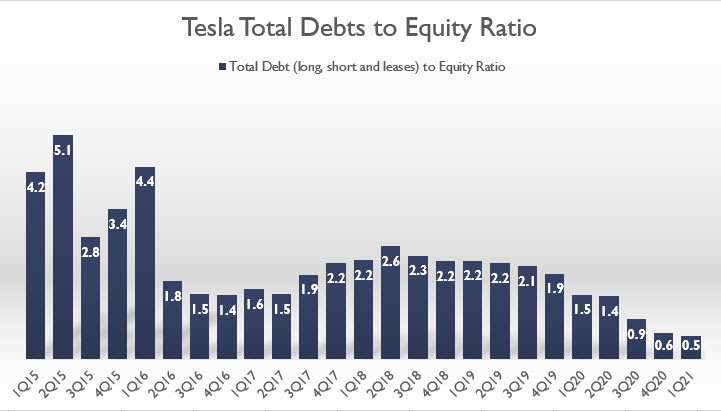

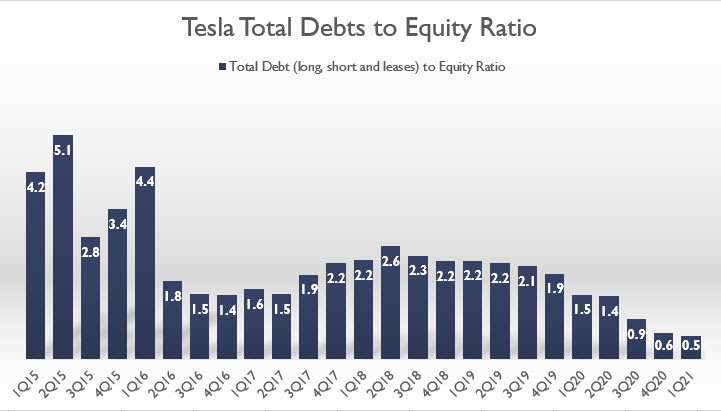

Total Debt to Total Capital 3752. Tesla Incs debt to equity ratio improved from Q3 2020 to Q4 2020 and from Q4 2020 to Q1 2021. Debt to capital ratio.

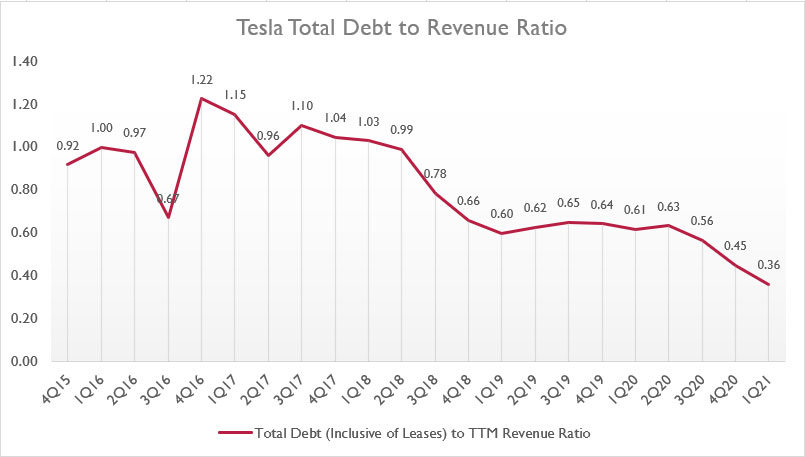

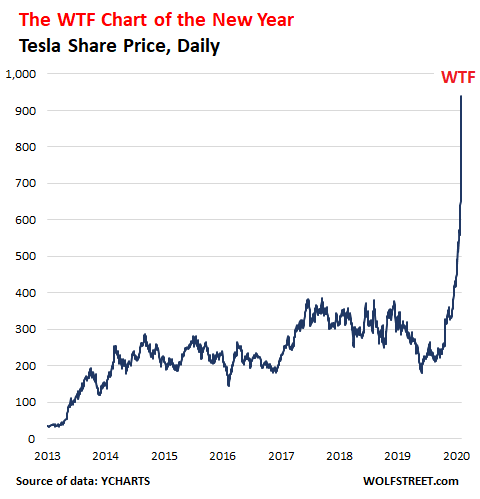

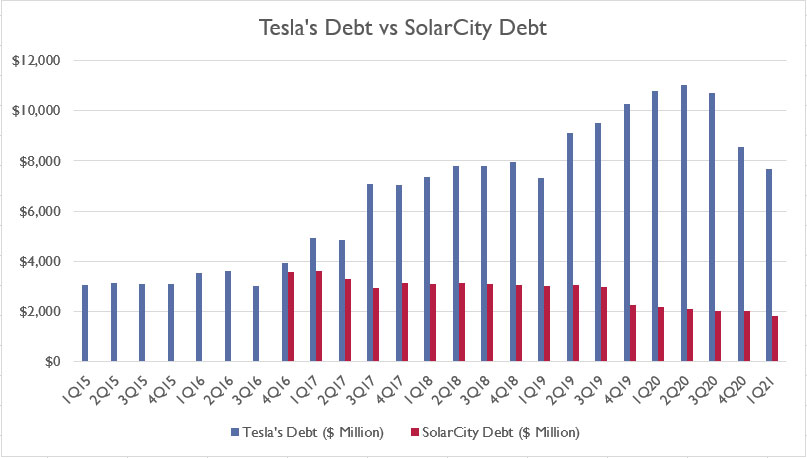

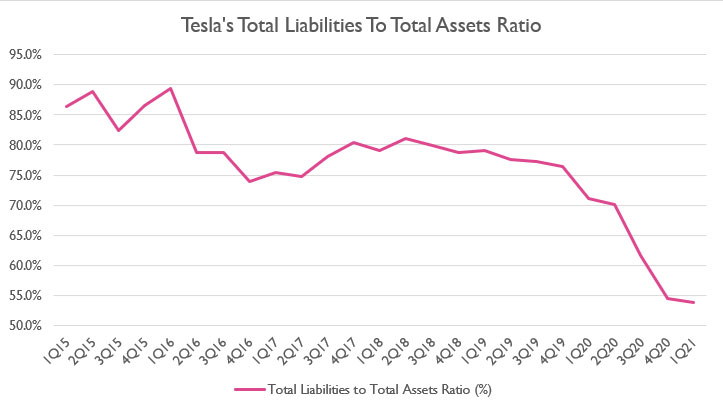

As far as the cash side is concerned the new tally is notable. The interest expense reflects part of Teslas expenses as a result of the companys existing debt. As shown in the chart above Teslas capital structure was mostly debt or liabilities prior to 2020.

Tesla beat estimates by a wide margin for the third quarter posting earnings of 186 per share versus an expected loss of 42 cents per share. October 13 2020 by Zachary Visconti Tesla TSLA has had a busy few months and its expected to release its Q3 earnings next week. Teslas long-term debt to total assests ratio for the quarter that ended in Mar.

Tesla long term debt for 2020 was 9607B a 1742 decline from 2019. A solvency ratio calculated as total debt divided by total debt. Debt to capital ratio including operating lease liability A solvency ratio calculated as total debt including operating lease liability divided by total debt including operating lease liability plus shareholders equity.

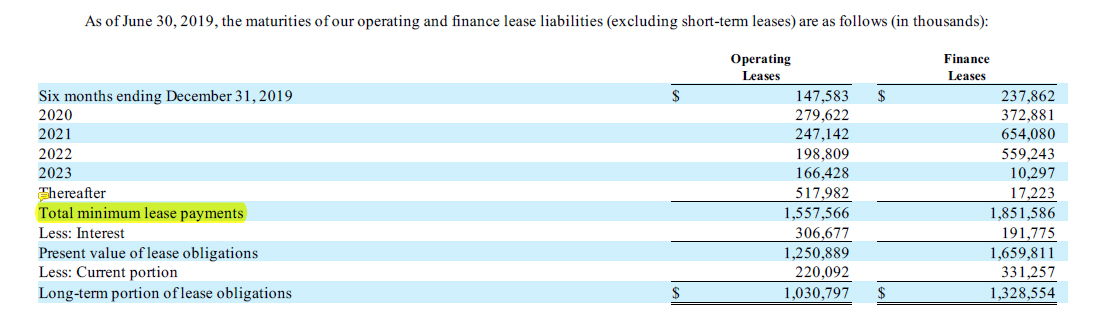

51 rows Tesla DebtEquity Ratio Historical Data. 1174B June 30 2019. The raise should also even out Teslas cash-to-debt position on its balance sheet at roughly 14 billion on both sides.

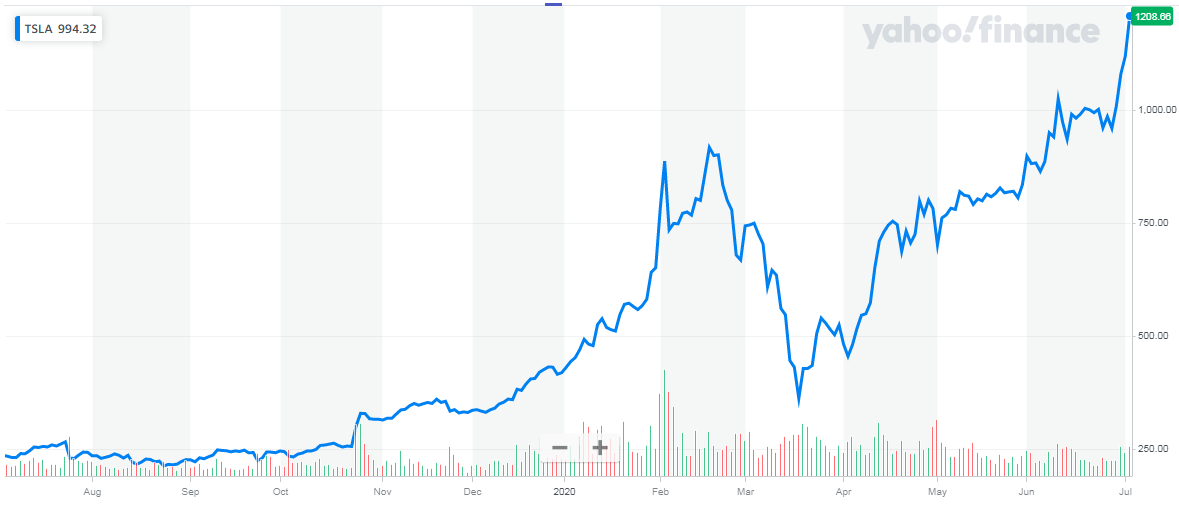

1224B June 30 2020. On Monday SP Global Ratings raised its debt ratings on Tesla from B to BB- according to Market Watch. Debt to equity ratio.

Teslas long-term debt to total assets ratio declined from Mar. TSLA had Debt to Equity Ratio of 051 for the most recently reported fiscal year ending 2020-12-31. Tesla long term debt for 2018 was 9404B a 015 decline from 2017.

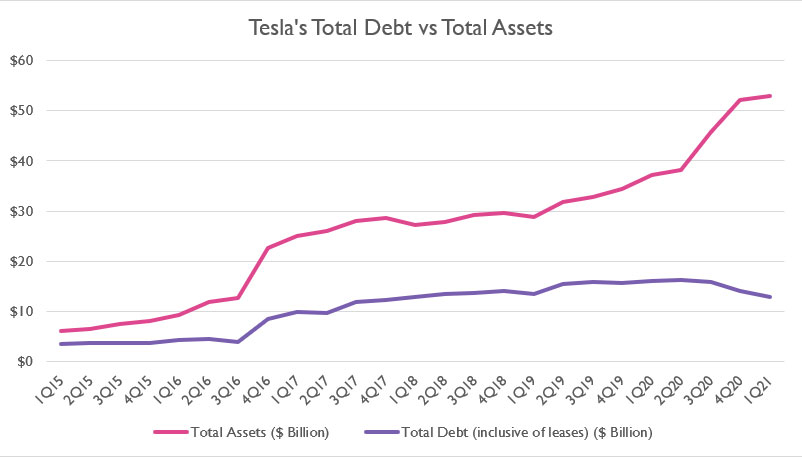

Net debt is less than 2 times estimated 2020 earnings before interest taxes depreciation and. Thereafter Teslas total debt has started to decline and reached about 95 billion as of 1Q 2021. 1261B March 31 2020.

From the chart Teslas total debt hit its peak figure at 13 billion recorded in 2Q 2020. 2020 031 to Mar. Tesla Incs debt to capital ratio improved from 2018 to 2019 and from 2019 to 2020.

Long-Term Debt to Total Capital 3061. Tesla has about 13 billion in debt on the books and about 69 billion net of cash on hand. For example Teslas total liabilities to total asset ratio had been above 75 between 2015 and 2019 indicating that the company had been entirely funded by liabilities.

This places the company just two notches away from an investment-grade rating. As the above chart shows Teslas interest expense has grown quite significantly over the past 6 years.

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

Tesla Capital Structure And Debt Leverage Is Changing Cash Flow Based Dividends Stock Screener

Tesla Tsla Q1 2021 Earnings Results 10 39b In Revenue Beats With 0 93 Eps

Tesla Major November 2020 Risk Nasdaq Tsla Seeking Alpha

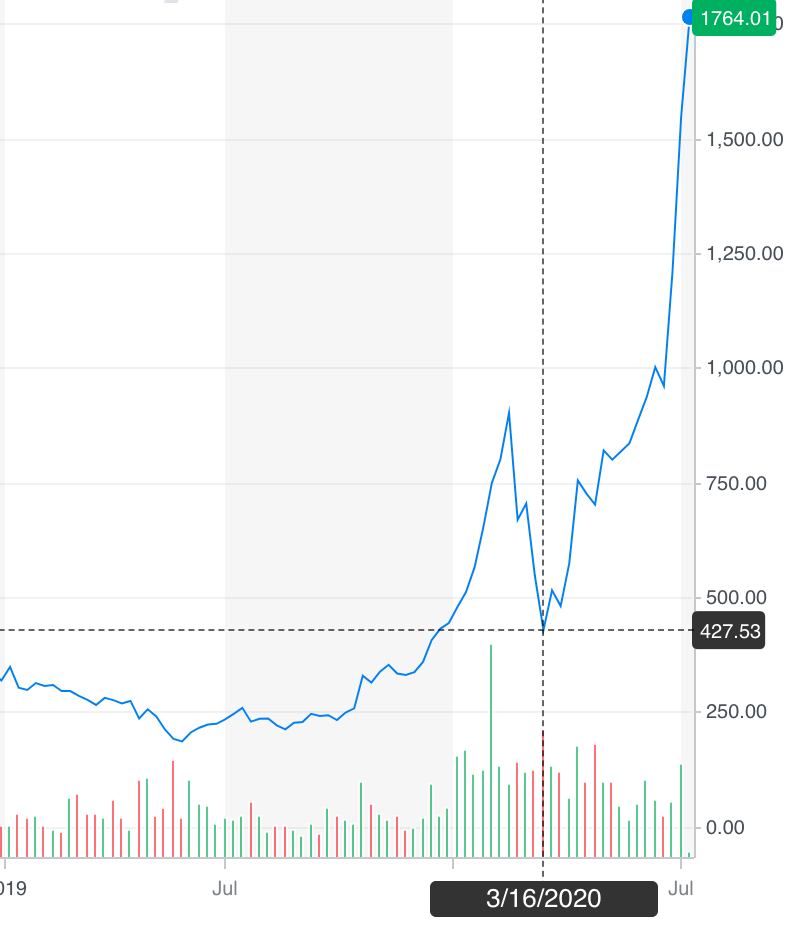

Tesla S Double Wtf Chart Of The Year Nasdaq Tsla Seeking Alpha

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

Tesla Capital Structure And Debt Leverage Is Changing Cash Flow Based Dividends Stock Screener

Tesla Capital Structure And Debt Leverage Is Changing Cash Flow Based Dividends Stock Screener

Is Tesla Stock A Good Buy Tesla Stock Analysis

Does Tesla Need A Capital Raise Cash Flow Based Dividends Stock Screener

Ericsson Nikola Tesla Balance Sheet Helgi Library

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

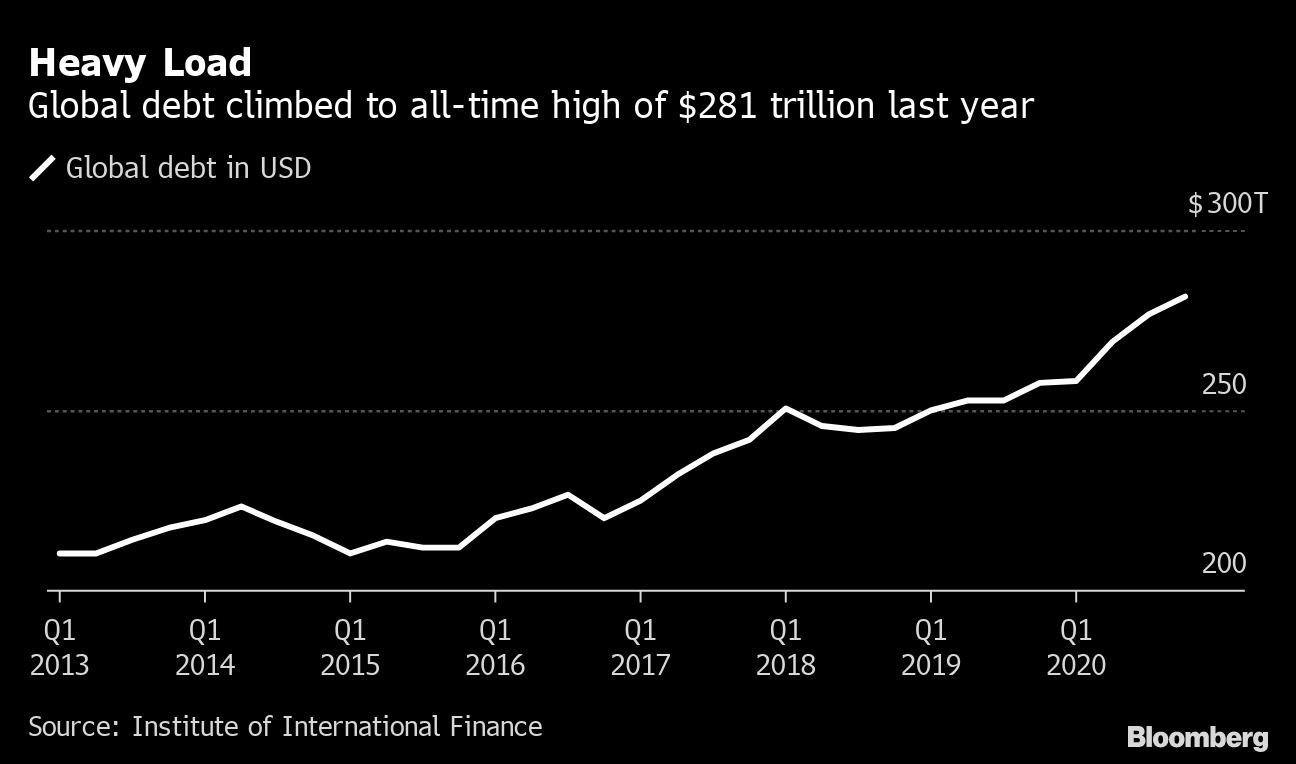

World Debt Reaches Record 281 Trillion Bloomberg

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

Tesla Stock Value Forecast Worth Trillions By 2030

Https Www Benzinga Com News 20 07 16730755 A Look Into Teslas Debt

Is Tesla 10 Billion Debt A Cause For Concern Cash Flow Based Dividends Stock Screener

Tesla Capital Structure And Debt Leverage Is Changing Cash Flow Based Dividends Stock Screener

Komentar

Posting Komentar